How much do game devs make selling games on Steam?

Can’t speak for everyone. But, here’s my experience with my Steam game, Abridge (2D Sokoban-style puzzle game).

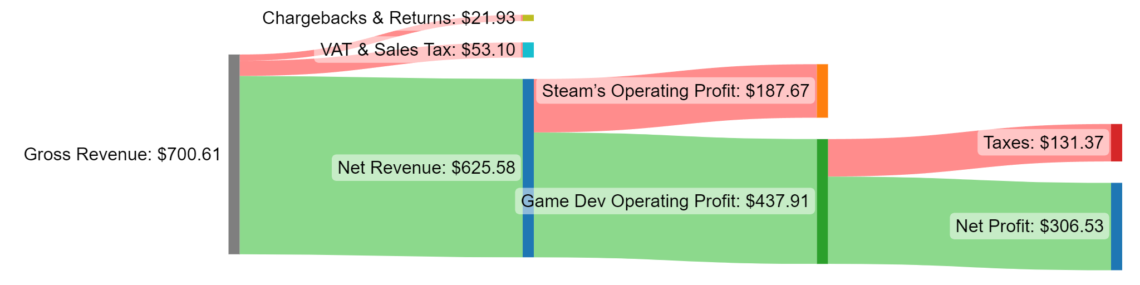

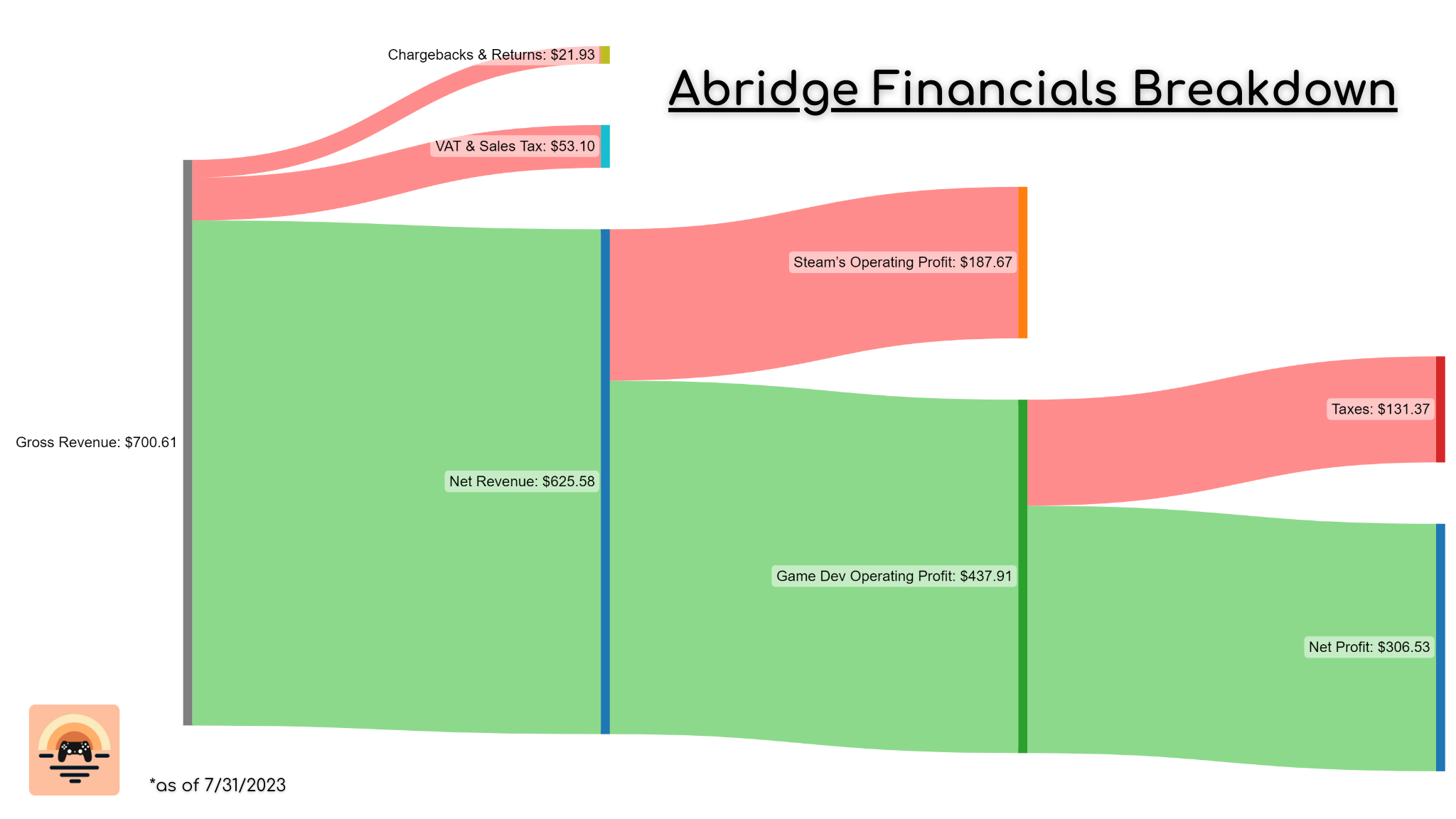

TL;DR*

- Gross Revenue: $700.61

- Net Profit: $306.53 (43.8% of Gross Revenue)

- Sold 176 units

- Chargebacks and Returns

- 6 units of $21.93 (3.3% of Gross Revenue)

How did I arrive at these values?

Steam provides gross revenue, units sold, and chargeback and returns using Steamworks. With these values and a few calculations, I get my Net Profit (or the money I get to keep). Understanding these values and calculations to arrive at Net Profit is goal of this blog.

Let’s jump right into it!

Game revenue on Steam breaks down into 3 phases:

- Gross Revenue to Net Revenue

- Revenue Sharing

- Net Profit

The goal of each phase is to understand what is taking our precious revenue. Included are examples using Abridge’s financials.

Gross to Net Revenue Phase

This phase’s goal is to convert Gross Revenue to Net Revenue. Here’s how you do that:

Net Revenue = Gross Revenue – Chargeback & Returns – VAT & Sales Tax

Definitions:

- Net Revenue is the Gross Revenue minus the sum of Chargeback & Returns and VAT & Sales Tax (Calculated)

- Gross Revenue is the total money your game has brought in (Source: Steamworks)

- Chargeback & Returns is the money returned to players due to returns and chargebacks (Source: Steamworks)

- VAT & Sales Tax is the taxation on game purchase based on players location (Source: Steamworks)

Here’s the numbers for Abridge*,

| Component | Amount | % of Gross Revenue |

| Gross Revenue | $700.61 | 100% |

| Chargeback & Returns | $(21.93) | 3.1% |

| VAT & Sales Tax | $(53.10) | 7.6% |

| Net Revenue | $625.58 | 89.3% |

I lost 10.7% or $75.03 off the top.

I have a small Chargeback & Returns rate of 3.3.% over Abridge’s lifetime. According to GameDiscoverCo, they observed refund rates between 3% and 17% per 1 month.

No way around the VAT and sales tax. It varies on location.

How much of these do we keep? Let’s continue on to the Revenue Share phase.

Revenue Sharing Phase

In this phase, partners share the incoming revenue based on a predetermined agreement. Steam is one partner and you and I, as the game dev, are the other.

Here, Steam takes their 30% cut of the Net Revenue. Breaking that down, we get:

Steam’s Operating Profit = Net Revenue * 0.3

To get our your cut of revenue sharing:

Game Dev Operating Profit = Net Revenue – Steam’s Operating Profit

Game Dev Operating Profit = Net Revenue – (Net Revenue * 0.3)

Game Dev Operating Profit = Net Revenue * (1 – 0.3)

Game Dev Operating Profit = Net Revenue * 0.7

Definitions:

- Operating Profit is each partners portion of Net Revenue before taxes

Expanding the example using Abridge*:

| Component | Amount | % of Net Revenue | % of Gross Revenue |

| Net Revenue | $625.58 | 100% | 89.3% |

| Steam’s Operating Profit | $(187.67) | 30% | 26.8% |

| Game Dev Operating Profit | $437.91 | 70% | 62.5% |

My earned Game Dev Operating Profit is diminishing. I kept 62.5% of the Gross Revenue.

Also, I didn’t have a publisher. If I did, they would take their cut here.

Furthermore, other PC Marketplaces take different percentages, like Epic Games Store take 12%. This will alter your outcome too.

Let’s finish off this financial quest with the final phase: Net Profit.

Net Profit Phase

Let’s determine the final amount we get to keep (i.e. Net Profit). Here’s how to find it:

Net Profit = Game Dev Operating Profit * (1 – Tax Rate)

Definitions:

- Net Profit is money you’ve made and get to keep

- Tax Rate is the percentage of profits used for taxes

Finishing the example with Abridge*:

| Component | Amount | % of Net Revenue | % of Gross Revenue |

| Game Dev Operating Profit | $437.91 | 70% | 62.5% |

| Tax Rate (30%) | $(131.37) | 21% | 18.8% |

| Net Profit | $306.53 | 49% | 43.8% |

In the end, I got 306.53 (or 49%), which is less than half of what the game brought in.

Tax Rates vary on your location. In the US, mine rate is 30%. Also, you are responsible for managing taxes, not Steam. You can have Steam take them out (Withholding Taxes on Steam). Don’t forget about taxes.

Steam distributes funds at the end of each month. Only when your running total of Game Dev Operating Profit exceeds $100.

Summary

| Phases | Component | Amount | % of Gross Revenue | % of Net Revenue | ||

| Gross to Net Revenue | Gross Revenue | $700.61 | 100% | N/A | ||

| Chargeback & Returns | $(21.93) | 3.1% | N/A | |||

| VAT & Sales Tax | $(53.10) | 7.6% | N/A | |||

| Revenue Sharing | Net Revenue | $625.58 | 89.3% | 100% | ||

| Steam’s Operating Profit | $(187.67) | 26.8% | 30% | |||

| Net Profit | Game Dev Operating Profit | $437.91 | 62.5% | 70% | ||

| Tax Rate (30%) | $(131.37) | 18.8% | 21% | |||

| Net Profit | $306.53 | 43.8% | 49% | |||

Formulas:

- Gross Revenue to Net Revenue Phase

- Net Revenue = Gross Revenue – Chargeback & Returns – VAT & Sales Tax

- Revenue Sharing Phase

- Game Dev Operating Profit = Net Revenue – Steam’s Operating Profit

- Steam’s Operating Profit = Net Revenue * 0.3

- Game Dev Operating Profit = Net Revenue * 0.7

- Net Profit Phase

- Net Profit = Game Dev Operating Profit * (1 – Tax Rate)

* as of 7/31/2023